Gold is one of the most fascinating discoveries of all time. The desire to own it has led to gold rushes and even worse, war. Today, gold is not only sought after for jewelry but also investment purposes. Here are some of the factors that drive the price of gold.

Central Bank Reserves

Central Banks are responsible for holding paper currencies and gold in reserve. In the U.S., the Central Banking System is known as the Federal Reserve System. Many of the nations throughout the world, including Germany, Italy, France, and Portugal have reserves that are primarily composed of gold. When these reserves buy more gold than they sell, the price of gold rises.

Value of U.S. Dollar

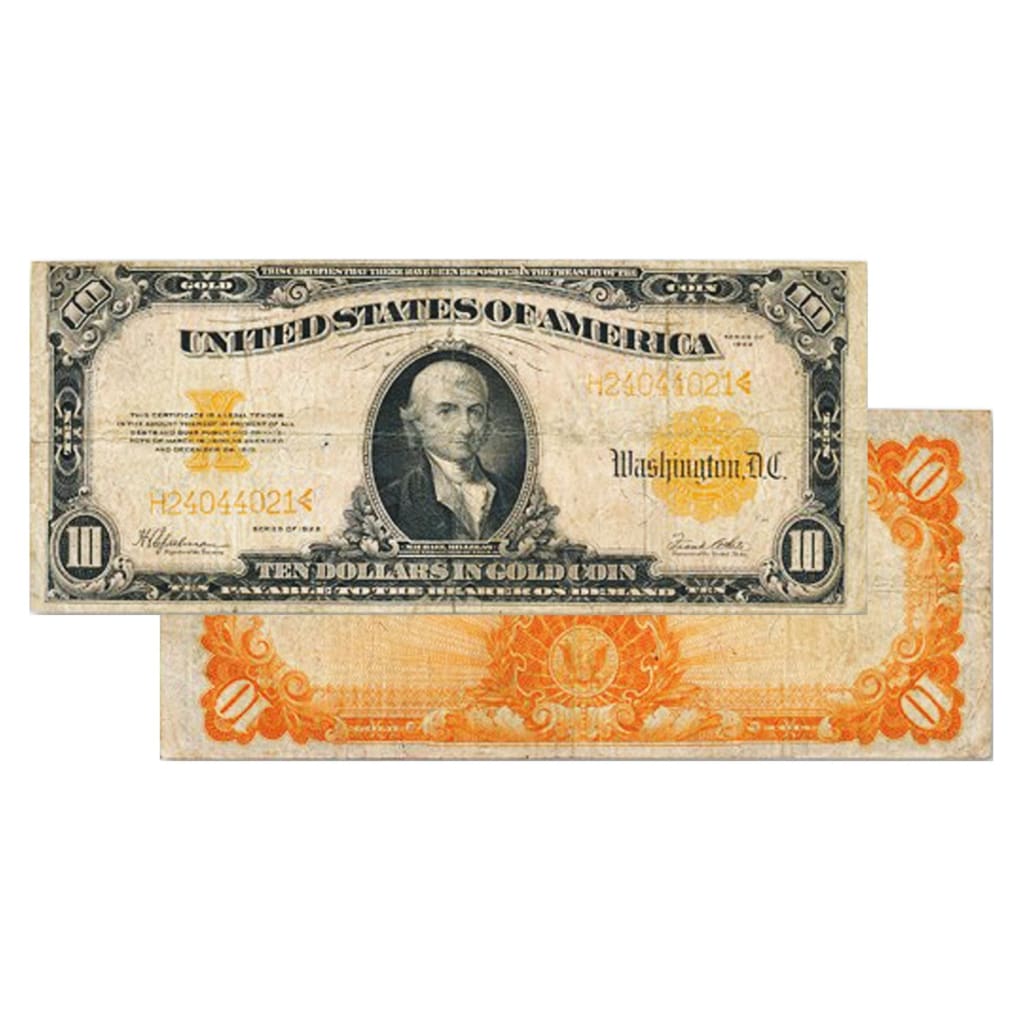

The price of gold is inversely related to the value of the U.S. dollar. For this reason, when the value of the dollar decreases the price of gold tends to increase. This is because people have a tendency to invest and trade in dollars when the dollar is strong. However, when the dollar is weak, people prefer to invest in gold. You can do this through gold coins.

Demand in Jewelry

Jewelry accounts for the largest proportion of gold manufacturing and consumption. According to the World Gold Council, gold jewelry accounted for 42 percent of global gold demand in 2012. By volume, India, China and the U.S. are by far the largest consumers of gold for jewelry. Therefore, the price of gold can also be affected by the laws of supply and demand. As the demand for consumer goods such as jewelry increases, so does the price of gold.

Wealth Protection

People continue to invest in gold, due to its enduring value. For investors, gold is often sought after during times of economic uncertainty. For others, it’s sold off during times of hardship or depression. Gold can also be used to hedge against currency devaluation, inflation or deflation.

While the price of gold has dropped significantly since 2011, there is still a demand. The central banks’ reserves, the value of the U.S. dollar, the overwhelming desire for jewelry, and the global economy will continue to help drive the price of gold.

Gary Dyner is the owner of Great American Coin Company. Connect with him on Google+.